how to cost average stocks

Whether you are trading Bitcoin Stocks or Forex. Add a minimum of two.

Dollar Cost Averaging Guide Brighton Jones Wealth Management Wealth Management

Using the average down calculator the user can calculate the stocks average price if the investor bought the stock differently and with other costs and share amounts.

. Ad Stock Research Trading Tools Designed for New Experienced Traders. Averaging down is an investment strategy that involves buying more of a stock after its price declines which lowers its average cost. Instead of investing in a particular security at.

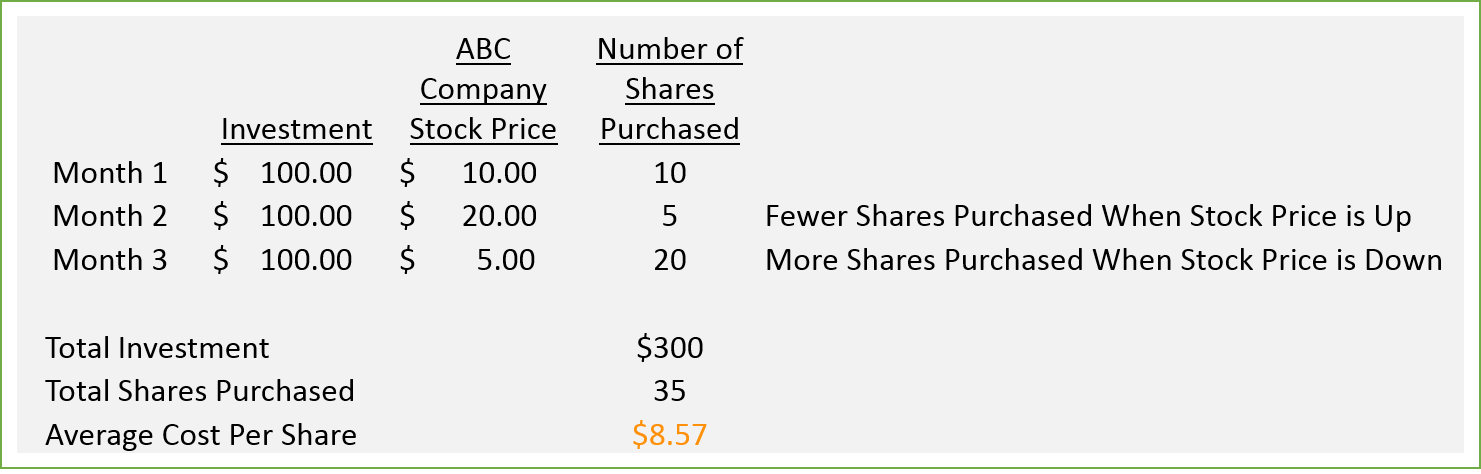

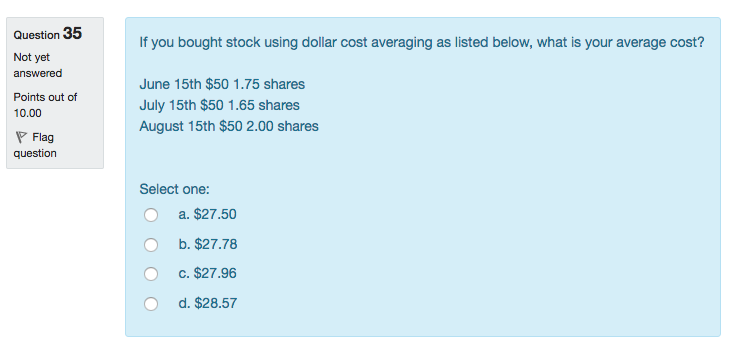

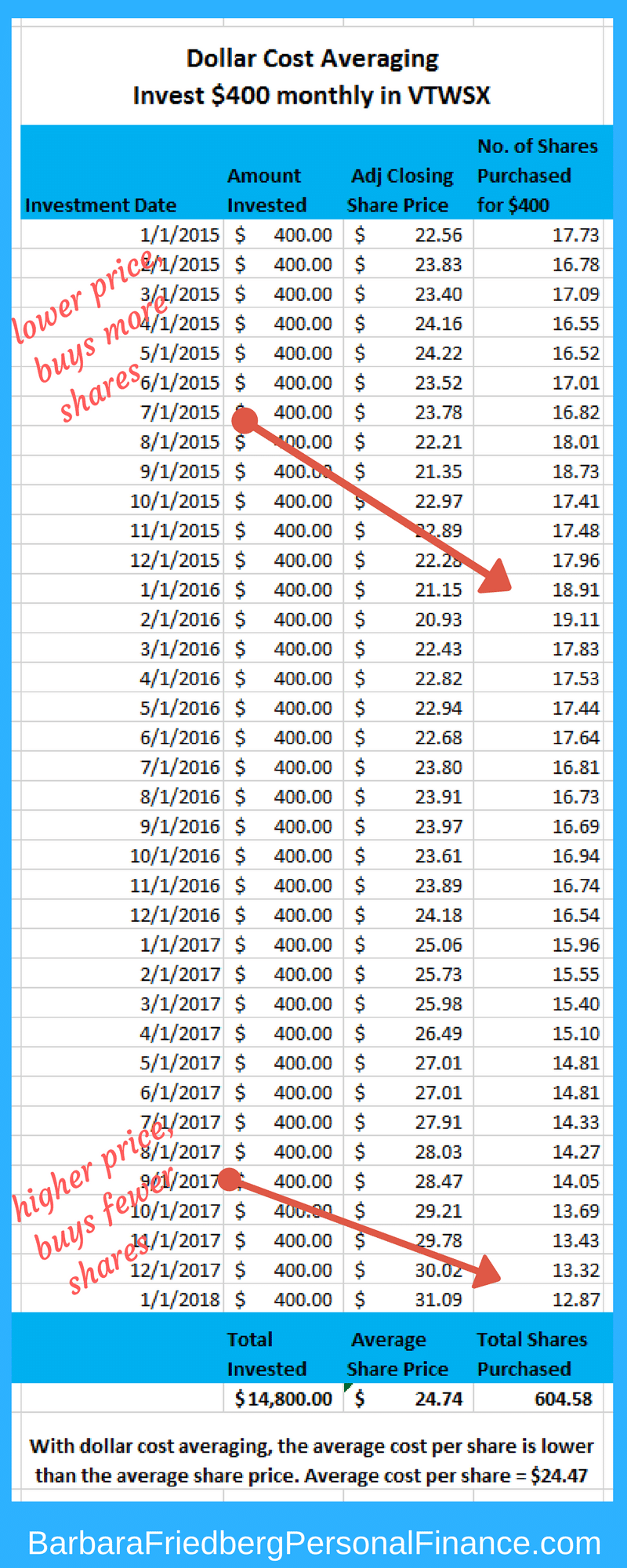

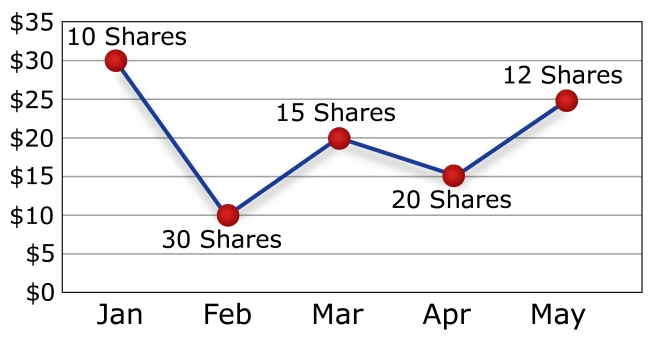

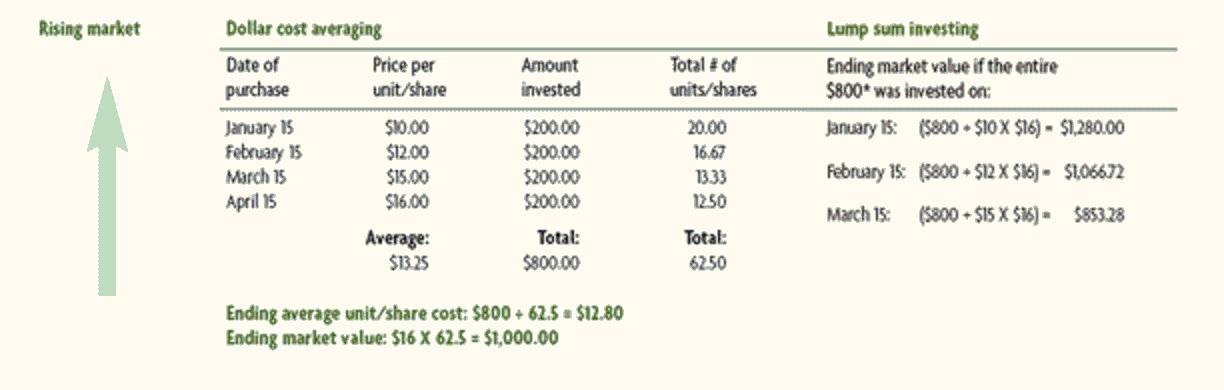

Dollar-cost averaging DCA is an investment technique of buying a fixed dollar amount of a particular investment on a regular schedule regardless of the share price. The average stock calculator is an application that calculates the average cost of your stocks when you purchase the same stock multiple times. In this example multiply 100 by 10 to get 1000 multiply 200 by 7 to get.

Multiply the number of shares in each transaction by its purchase price. Note here that multiple times doesnt. Cost basis is reported on IRS Form 1099 B.

After using all of your intended 5000 for this trade you purchased 2534 shares for a dollar-cost average stock price of 1973. Take the original investment amount 10000 and divide it by the new number of shares you hold 2000. This tool allows you to determine the average entry and the exit price for your.

Lets stick with your original 100 shares of stock with a cost basis of 2500. In five years youll have 4000 in each stock and a portfolio worth 120000. Averaging down is a viable investment strategy for stocks mutual funds and exchange-traded funds.

Simply add the number of shares and the average Buying or the total cost. Average Cost per share Total purchases 2750 total number of shares owned 5661 4858. Open an Account Now.

Our top picks for online brokers. Simply buy 66 2000 30 worth of each stock at the beginning of every month. If the stock fell to 10 and you bought another 100 shares your average price per share would be 15.

Dollar-cost averaging requires the investor to invest the same amount of money in the same stock on a regular basis over time regardless of the share price. You would be decreasing the price at which you originally owned the stock. You can calculate your cost basis per share in two ways.

If the stock trades at 10 one month you will buy. From novice to expert these are the brokers for you. If you receive a Form 1099 B and the cost basis box is empty there are other ways to find the cost basis for old stock.

Ad No Hidden Fees or Minimum Trade Requirements. To calculate the average cost divide the total purchase amount. However investors should exercise care in deciding which positions to.

Calculate Your Total Cost. Average cost calculator is a handy tool for traders and investors. If you buy a stock multiple times and want to calculate the average price that you paid for the stock the average.

Online dollar cost average calculator DCA calculator helps you to find the average cost. Ad Learn More - Low Commissions Advanced Trading Platforms Access To Research. The dollar-cost averaging approach helps investors avoid market timing but they give up some potential for higher returns.

Stock Average Calculator to calculate the average stock price of your stocks. Dollar cost averaging is a strategy to manage price risk when youre buying stocks exchange-traded funds ETFs or mutual funds. You can average down the price of your stock if you buy more shares when the price has fallen.

Lets say you buy 100.

Dollar Cost Averaging Is A Bad Retirement Investing Strategy Money

Solved Question 35 Not Yet Answered Points Out Of 10 00 If Chegg Com

How To Buy Low And Sell High With Dollar Cost Averaging

Here S How To Dollar Cost Average Into Positions In A Bear Market Marketbeat

305 Dollar Cost Averaging Images Stock Photos Vectors Shutterstock

The Power Of Dollar Cost Average Investing

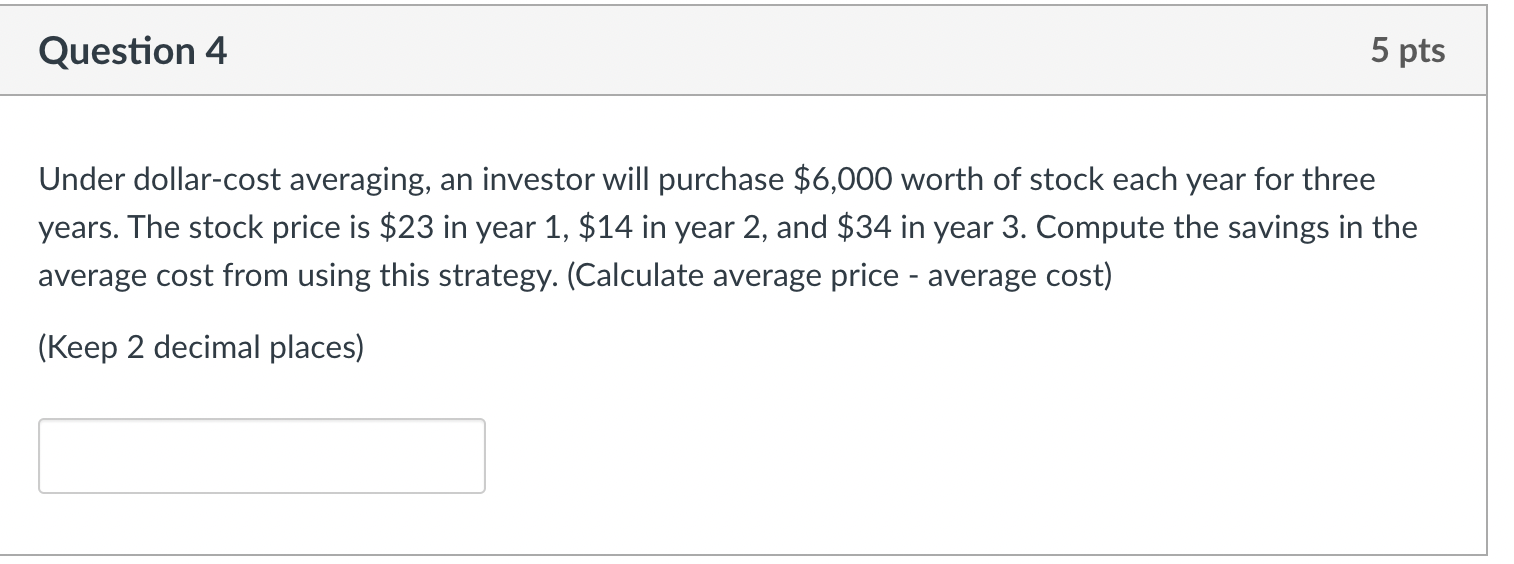

Solved Question 4 5 Pts Under Dollar Cost Averaging An Chegg Com

7 Advantages Of Dollar Cost Averaging Dividend Stocks Right Now Dividends Diversify

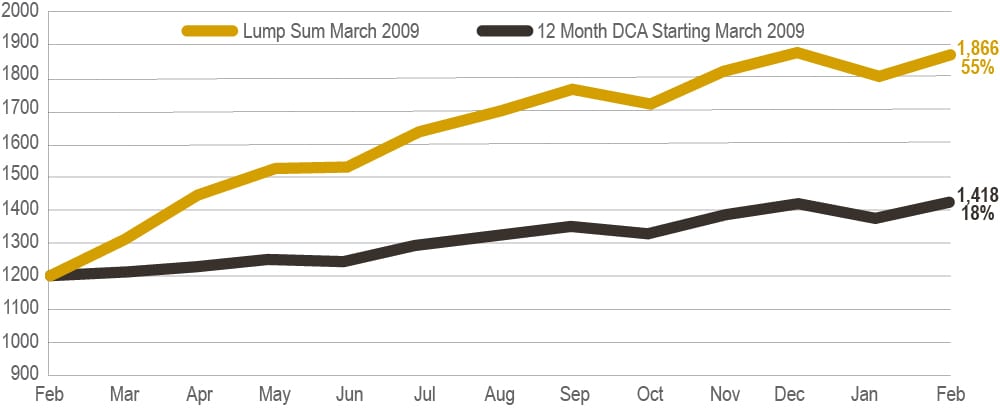

Lump Sum Vs Dollar Cost Averaging Which Is Better Select Portfolio Management Inc

:max_bytes(150000):strip_icc()/dotdash_Final_Dollar_Cost_Averaging_DCA_Aug_2020-01-65c3107f5de8437ba6397cafbd1093fc.jpg)

Dollar Cost Averaging Dca Explained With Examples And Considerations

Three Ways Dollar Cost Averaging Helps Investors

A Free Calculator To Help You Calculate Your Dollar Cost Average Investments

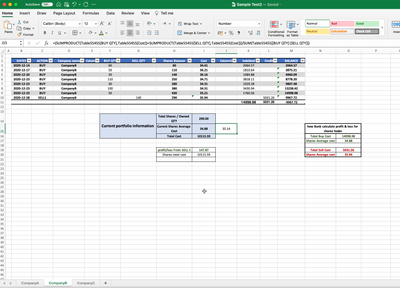

Dollar Cost Averaging Explained Using Excel Youtube

Long Term Stock Investments Explained 2022 Beginner S Guide

Dollar Cost Averaging Investing Strategy Examples

Dollar Cost Averaging For Better Stock Investing Snider Advisors

Dollar Cost Averaging Investing Strategy Examples

The Myth Of Dollar Cost Averaging Seeking Alpha

Calculate Profit And Loss And Average Cost For My Portfolio In Stock Market Microsoft Tech Community